Where Should I Invest: Real Estate or Stock?

The Reality of Investing in Bangladesh

In our economy, where bank interest rates barely beat inflation, gold prices swing like a pendulum, and dollar rates change with political winds, your investment choice is more about survival than growth.

The stock market might promise quick riches but delivers an average return of 5.54% over a decade (Bangladesh Bank data), with 16% crashes that can wipe out years of savings in weeks—not to mention the sleepless nights watching your life savings fluctuate wildly. In most cases, it plays with your blood pressure more than your money. And by "most cases," I meant MOST cases.

On the other hand, real estate offers stability but demands massive upfront capital (even 30% of ₹10 crore is ₹3 crore) and years of patience before yielding returns.

What keeps smart investors awake at night is that this single decision could determine whether your money works for you or disappears slowly—whether you build generational wealth or generational regret, whether you retire early or work until you're 70. The stakes couldn't be higher.

In this article, we’ll break down the historical performance of stocks vs. real estate in Bangladesh, case studies of actual investors, tax benefits, loan advantages, hidden costs, and when to invest. By the end, you’ll know exactly where to put your money—with data-backed proof.

Understanding Real Estate vs. Stocks in Bangladesh’s Volatile Economy

Real Estate: The Brick-and-Mortar Foundation of Wealth

In Bangladesh, real estate isn’t just an asset class—it’s a cultural institution. Unlike stocks that exist as digital entries, property investment involves physical land and structures, giving investors something they can see, touch, and control. This tangibility provides psychological comfort, especially in an economy where trust in financial institutions remains shaky.

The Bangladeshi real estate market operates as an imperfect market, meaning prices aren’t standardized. A commercial space in Gulshan can command ৳60,000 per sqft, while a similar property in Mohammadpur may sell for just ৳15,000 per sqft. This disparity stems from location desirability, infrastructure development, and developer reputation. Projects by established names like Amin Mohammad Foundation Ltd. carry premium valuations due to their track record, whereas lesser-known developers often struggle with liquidity, even when offering discounts.

Historical Resilience Through Economic Turbulence

Bangladesh’s property market has demonstrated remarkable resilience over the decades. During the 2008 global financial crisis, while stock markets worldwide collapsed, Dhaka’s prime real estate continued appreciating at 8-10% annually. The COVID-19 pandemic (2020-2022) saw a brief slowdown in transactions, but prices did not crash—instead, they stabilized with a 3-5% annual increase, according to Bangladesh Bureau of Statistics (BBS) data.

This stability stems from fundamental demand drivers:

- Urbanization: Dhaka adds 500,000+ new residents yearly, creating relentless housing demand

- Limited Land Supply: Only 17% of Dhaka’s land is residential per RAJUK estimates

- Inflation Hedge: Construction costs rise 12-15% annually, pushing property values up

The 2024 Market Reality – Challenges & Hidden Opportunities

The current real estate landscape presents a paradox. While REHAB (Real Estate & Housing Association of Bangladesh) reports 3.79% sector growth in FY24, liquidity remains tight. High-net-worth individuals continue buying prime assets, but middle-class buyers face financing hurdles due to:

- Mortgage interest rates at 11-13% (up from 9% pre-2022)

- Stricter loan-to-value ratios (now capped at 70% for most banks)

Yet, strategic opportunities exist:

- Pre-Launch Discounts: Early investors get 10–20% lower rates in upcoming projects.

- Commercial properties near metro rail stations yield 6-8% rental returns, outperforming bank deposits

- Infrastructure Growth: Areas near Dhaka Metro Rail or Padma Bridge have seen 20–30% appreciation in the last 3 years (Source: REHAB Bangladesh).

The Stock Market: A Rollercoaster of Opportunity and Heartbreak

The Dhaka Stock Exchange (DSE), established in 1954, operates as a near-perfect market with transparent pricing—at least in theory. In practice, retail investors face a market dominated by:

- Institutional players controlling 60% of turnover

- Volatility spikes during political unrest or banking crises

- Limited quality listings, with banks comprising 42% of market cap

Unlike real estate’s slow movements, stocks can swing 5% in a single day. The DSEX index has oscillated between 4,200 and 7,400 points since 2019—enough to give investors whiplash.

A Decade of Market Cycles – Lessons from History

The past 10 years reveal distinct market phases:

- 2013-2017 Bull Run: DSEX surged 80%, fueled by telecom (Grameenphone) and banking stocks

- 2018-2020 Crisis: The index collapsed 28% after the banking sector’s non-performing loans (NPL) scandal

- 2021 Retail Frenzy: Small investors flooded the market, pushing DSEX to 7,300 before the 2022 correction

- 2024 Reality Check: The index sits 16% below its peak with foreign investors pulling out $120 million this fiscal year

The Current Investment Landscape – By the Numbers

2024 presents a complex picture for equity investors:

- Valuation Concerns: Market P/E ratio at 22.5x versus 15x historical average

- Sectoral Divergence:

- Pharmaceuticals growing at 12-15% EPS

- Textiles struggling with 5% margin compression

- Banking sector weighed down by 9.3% NPLs (Bangladesh Bank data)

- Liquidity Crunch: Daily turnover averaging ৳500 crore, down from ৳1,200 crore in 2021

Why These Markets Behave Differently

Market Efficiency & Information Flow

Real estate transactions occur in an opaque environment where insider knowledge of zoning changes or infrastructure projects can mean 20-30% profit differences. In contrast, stock prices react instantly to public information—sometimes too violently, as seen when Grameenphone shares dropped 12% in a day after a regulatory dispute.

Liquidity vs. Stability Trade-off

Stocks offer instant liquidity—you can sell shares in minutes during market hours. But this comes with volatility; the 2024 market crash erased ৳1.5 lakh crore in wealth. Real estate provides price stability (values rarely drop), but selling a property takes 3-12 months, often requiring 10-15% price concessions for quick exits.

Leverage Dynamics – How Banks Favor Real Estate

Here lies the critical difference:

- Real estate investors can access 70-80% bank financing at 11-13% interest

- Stock investors get zero institutional leverage—only high-risk margin trading (rarely offered in Bangladesh)

This means with৳30 lakh, you can control:

- A৳1.5 crore property (using 80% loan)

- Only ৳30 lakh worth of stocks (no leverage)

Inflation Protection – A Vital Consideration

With Bangladesh’s inflation fluctuating between 6-9%, real estate’s hard asset nature provides better protection. Construction material costs (steel, cement) have risen 18-22% since 2022, pushing property values up. Stocks, however, often suffer during high inflation as corporate earnings get squeezed.

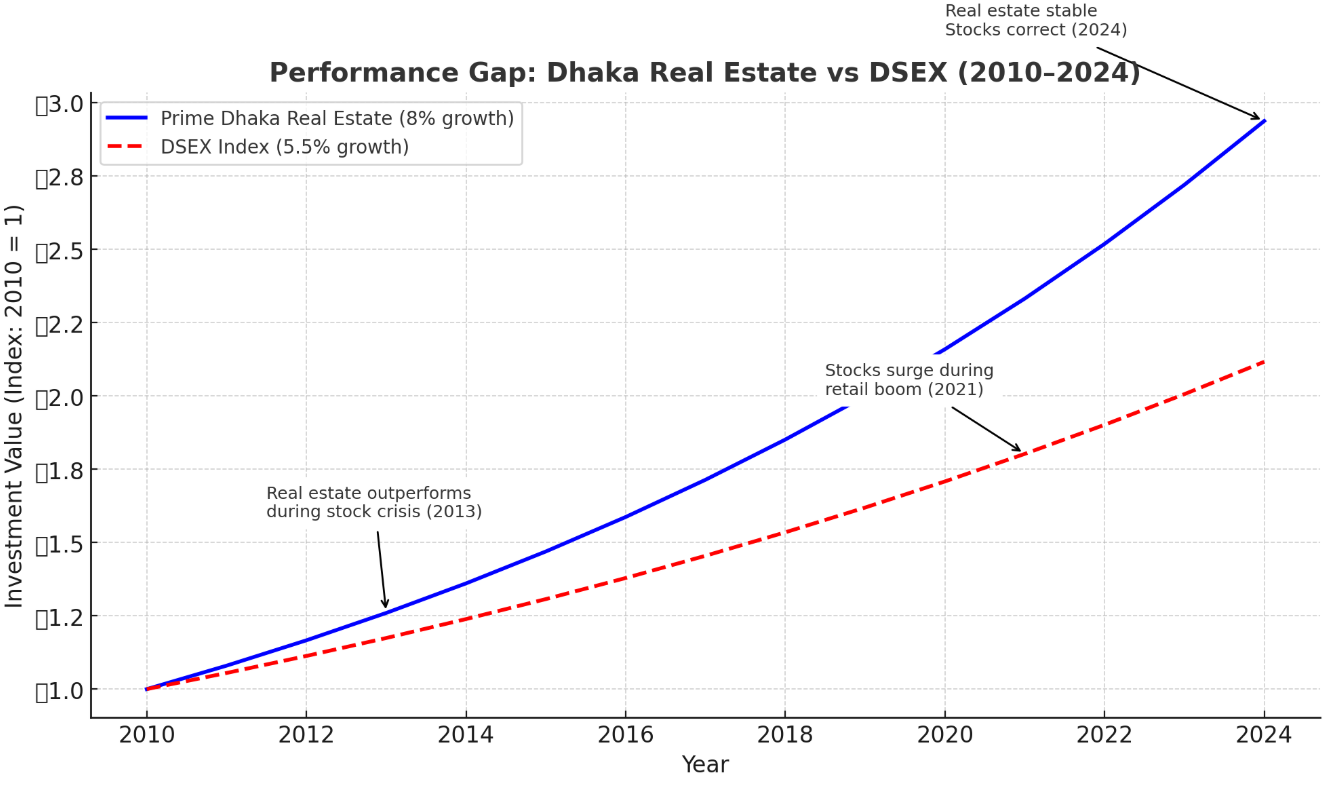

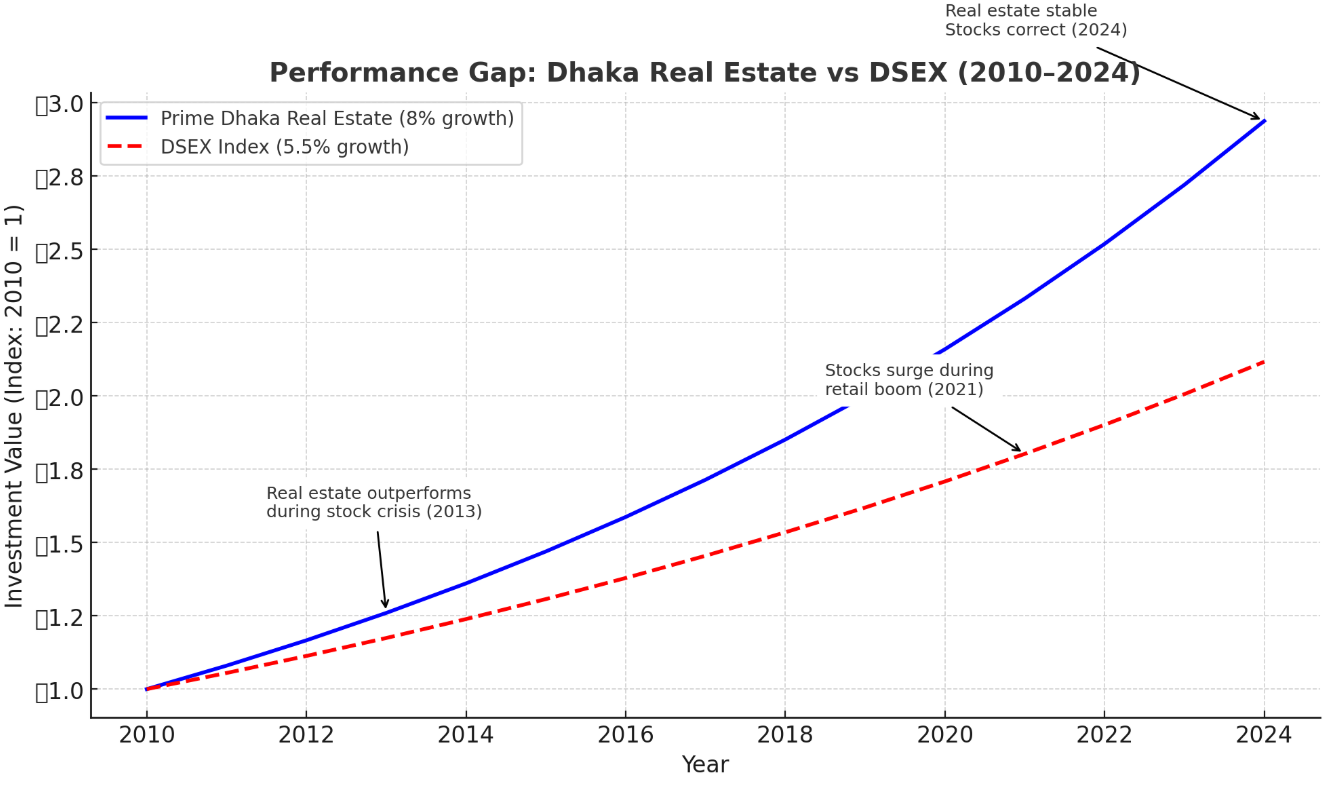

While stocks occasionally deliver short-term explosions (like 2021’s 82% return for some investors), real estate provides consistent compounding. A ৳1 crore investment in 2010 would now be worth:

- ৳3.2 crore in prime Dhaka property

- ৳2.1 crore in the DSEX index (before accounting for dividends)

The Real Estate Wealth Formula – How Investors Multiply Capital

In Bangladesh’s real estate market, the true magic lies in leveraged growth. Consider this scenario:

- Property Value: ৳1.5 crore (1,500 sqft at ৳10,000/sqft in a developing area)

- Your Investment: ৳30 lakh (30% down payment)

- Bank Loan: ৳1.2 crore (80% financing at 12% interest for 20 years)

After 10 years, assuming:

- Annual Appreciation: 8% (conservative for developing areas) → Property worth ৳3.24 crore

- Rental Income: 5% yield → ৳7.5 lakh/year covering 65% of EMI

- Loan Balance: ৳85 lakh remaining

Net Position:

- Sell for ৳3.24 crore

- Pay off ৳85 lakh loan

- Net Profit: ৳2.39 crore on ৳30 lakh investment → 697% return

Source: REHAB’s 2023 market analysis shows similar leveraged returns in developing projects

The Hidden Tax Advantages

Unlike stocks, real estate enjoys:

- No capital gains tax if held >5 years (NBR Ordinance)

- Mortgage interest deductions up to ৳25 lakh/year

- Depreciation benefits for commercial properties

Stock Market Returns

The Myth of "Average" Returns

While the DSEX has delivered 5.54% annual returns since 2010 (Bangladesh Bank), retail investors rarely achieve this due to:

- Transaction Costs:

- Brokerage (0.5%)

- CDS fees (0.05%)

- 15% tax on dividends

- Behavioral Pitfalls:

- Buying high during bubbles (2021 peak)

- Selling low in panics (2024 crash)

A Realistic 10-Year Stock Scenario

Investing ৳30 lakh equally in:

- Blue-chips (GP, Square Pharma)

- Growth stocks (BEXIMCO, Walton)

- Dividend payers (BD Lamps, BATBC)

Projected Outcome (After Costs):

- Best Case: 10% CAGR → ৳78 lakh

- Average Case: 6% → ৳54 lakh

- Worst Case: 2010-2014 repeat (-4% CAGR) → ৳20 lakh

DSE data shows only 12% of retail investors beat inflation over 10 years

Case Studies – Real Investors, Real Outcomes

In 2018, Green Rowshonara Tower—a premium corner-plot commercial development by Amin Mohammad Foundation Ltd. situated in the heart of Dhanmondi—was nearing completion. Among the keen investors were Mr. X and Mr. Y, both with their eyes on long-term returns, but with very different strategies.

Mr. X decided to invest in the 8th floor, acquiring 7,000 sft at ৳20,000 per sft, totaling ৳14 crore. Since the building was already constructed and only finishing touches were left, there was no opportunity for long-term installment payments. So Mr. X went for a smart financing move:

- He paid ৳7 crore from his own funds.

- The remaining ৳7 crore was financed through a term mortgage loan, using the property itself as collateral (since the project was ready).

- Thanks to structured support, he began repaying the loan three months later, just as the building was completed.

Mr. X rented the entire space to an international company, securing three years’ rent in advance. The rental income was set at 2% of the total property value, which is about ৳28 lakh per year. This rent covered his monthly loan installments, and still left some cash in hand.

Fast forward 10 years:

- The loan is fully repaid.

- Mr. X now owns a property that was worth ৳14 crore—but will likely be valued at ৳18 crore or more.

- Even if he sells at ৳25,000 per sft, below market price, he still walks away with a clear profit.

- Or, he could continue renting and enjoy 100% of the rental income, now debt-free.

With an original investment of only ৳7 crore, Mr. X ended up owning a significantly appreciated asset, thanks to strategic financing and rental leverage.

On the other hand, unlike Mr. X, Mr.Y made his move when Green Rowshonara Tower was just an idea on paper—right after the signboard went up.

He chose a ground floor space, paying through a 5-year developer installment plan:

- 30% down payment, plus monthly payments (approx. ৳2 lakh/month).

- No bank loans, no interest, no mortgage.

Since he was an early investor, he received a significant discount compared to later buyers. By the time the building was complete, Mr.Y had paid off the full amount and owned the property outright.

His reward for his patience were:

- He secured prime space at the lowest possible rate.

- As the building’s market value increased, his investment appreciated sharply.

- He can now sell at market price or rent for full return—with zero debt liability.

(Source: Amin Mohammad Foundation Ltd. project data, Bangladesh Bank mortgage trends)

The Stock Market Gambler: Mr. Z’s Rollercoaster Ride

In 2020, Mr. Z, a mid-level corporate executive, ventured into the Dhaka Stock Exchange (DSE) with his entire life savings—৳50 lakh—driven by dreams of rapid growth and financial independence. Lured by the buzz around initial public offerings and confident broker recommendations, he eagerly invested in hyped stocks: BEXIMCO during its IPO frenzy, LafargeHolcim amid a cement sector boom, and IFIC Bank, enticed by its high dividend yield. Initially, the market rewarded his enthusiasm. By 2021, his portfolio had swelled to ৳1.2 crore at its peak.

But the high didn’t last. The 2022 market correction saw his holdings shrink to ৳80 lakh, and the 2024 crash dealt a final blow, dragging the value down to just ৳45 lakh. His strategy—chasing hot trends—proved costly. He bought BEXIMCO at ৳200 per share, now worth less than half that. Panic during margin calls led him to sell LafargeHolcim at a 40% loss. And IFIC’s modest 5% dividend yield offered little comfort as the stock’s value declined. After four years, Mr. Z ended up with a 10% loss on his principal—and even worse, inflation had eroded roughly 35% of his purchasing power.

(Source: DSE historical data, Bangladesh Bank inflation reports)

The Psychological Battle

The psychological toll of investing varies dramatically depending on the asset class. Take Mr. X, Mr.Y a real estate investor, and Mr. Z, a stock market participant. Mr. X and Y checks their property values maybe once a year and enjoys the stability of rent payments landing in their account without effort. Their stress is minimal, his sleep undisturbed.

In contrast, Mr. Z monitors his portfolio obsessively—five times a day—haunted by sudden market drops that can strike even at midnight. While Mr. X and Y feels a sense of control—able to renovate, hold, or sell on his terms—Mr. Z is at the mercy of market sentiment and unseen forces. Regret also hits differently: Mr. X and Y feels confident having bought at a fair price, while Mr. Z is plagued by thoughts of missed peaks and bad timing. Their mindsets reflect this difference. Mr. X and Y thinks in decades, planning for his grandchildren. Mr. Z is chasing rapid returns, hoping to double his money now.

The emotional contrast is stark—and costly.

The Final Verdict – By the Numbers

Metric | Commercial Real Estate in Dhanmondi. | Stock Market (DSE Portfolio) |

Initial Investment | ৳7 crore | ৳50 lakh |

Time Horizon | 6 years (2018-2024) | 4 years (2020-2024) |

Annualized ROI | 11.2% (Conservative) | -2.5% (Before inflation) |

Wealth Stability | Never dropped in value | Lost 62% from peak |

Tax Efficiency | No capital gains tax | 15% dividend tax + capital gains risk |

Why Real Estate Outperforms

When to Buy Property – Two Golden Rules

- Buy After Elections

- Property demand dips 15-20% pre-election due to uncertainty.

- Prices rebound 12-18% within a year post-election (2014, 2018 data).

- Watch Interest Rate Cuts

- Mortgage rates drop 3-6 months after Bangladesh Bank reduces repo rates.

- Example: 2021 rate cut to 5.75% triggered a 9% property surge.

(Data: Bangladesh Bank Monetary Policy Reports, REHAB Trends)

The Stock Market’s Hidden Risks – Two Brutal Truths

- Liquidity Illusion

- Small-cap stocks can take weeks to sell at fair prices despite "instant trading."

- 2024 Reality: Daily turnover dropped to ৳500 crore (vs. 2021’s ৳1,200 crore).

- Dividend Disappointment

- After 15% tax, even top dividend stocks like Grameenphone yield just 4.2% net.

- Only 11 DSE companies offer 6%+ yields consistently.

(Source: DSE Annual Report 2023, NBR Tax Data)

Hybrid Strategies – When to Blend Both (But Mostly Real Estate)

Smart Hybrid Investing – Two Simple Rules

- 80% Real Estate, 20% Stocks

- Core wealth in leveraged Dhaka/CTG properties.

- Stocks only for liquidity (GP, Square Pharma).

Where True Wealth Lives in Bangladesh

Imagine this: two old friends meet at a café in Gulshan, catching up after a decade.

One opens his phone to check stock updates. His portfolio, once worth ৳1 crore, is down over 20% this year. He explains it away with talk of "market cycles" and long-term strategy, but his eyes betray the stress. Every rise gives him hope; every dip steals a little sleep.

Across the table, the other sips his tea calmly. He owns a commercial property in Banani, now valued at ৳3.5 crore—up from ৳2 crore in 2019. Rent comes in like clockwork. He hasn't checked property values lately. Why would he? He sleeps soundly knowing the market works in his favor, silently and steadily.

That quiet confidence isn’t luck. It’s leverage. It’s timing. It’s patience. Real estate builds wealth and holds onto it.

Both friends invested. But only one truly owns peace of mind.

The choice between stocks and property is personal. But where land appreciates, banks support you, and rental income compounds quietly in the background—real estate proves, again and again, that it isn't just safer.

It’s smarter. In Bangladesh, land outlasts luck.

N.B.*Market conditions change rapidly. All data sourced from Bangladesh Bank, DSE, and REHAB reports (2018-2024). Verify current rates before investing.*